RevOps teams are justifiably driven to incorporate intent data in their prioritization strategies. Which makes perfect sense: in the world of demand gen and cold outreach, a prospect who has voluntarily expressed interest in a solution your company offers is way more likely to buy than someone who hasn’t. Intent data offers much better predictive capabilities than standard firmographic filters (like industry, headcount, location or revenue).

Intent data is powerful. There’s no doubt about it. However, it may not be giving you the full spread of information you need to maximize your conversions. For example, intent data can overemphasize “window shoppers,” lookie-loos who are only checking things out because they cost little to nothing.

Sure, a prospect downloaded a white paper or attended a webinar in exchange for a live email address, but those actions could be lightweight indicators of actual readiness. Typically, 66% or more of prospects on a normal, unfiltered intent list are such window shoppers—not the hot prospects you’re most likely to land a meeting with.

But when you pair intent data with exegraphics? Now, you’re unlocking the real potential of both data sets to optimize your sales pipeline.

How exegraphics differ from intent

Exegraphics and intent data offer essentially a macro- and a micro-view of a potential customer. Intent signals reflect individual actions that indicate some amount of willingness to engage with your company’s offerings. Exegraphics are demand signals: they reveal the inner workings of companies and how they execute their mission.

An exegraphic is essentially any characteristic you would want to know about a company—even if that information is not readily accessible. The B2C giants have been in on this concept for years with psychographics that extend well beyond demographics: the large data attractors (think Amazon or Google) can predict what you’ll want to buy, as an individual consumer, before you know it yourself. Exegraphics offer similar insights for the B2B world.

AI-driven exegraphics look at companies two ways: one is a focus on a company’s position in its industry and the value it offers to its market. The other focuses on the functions of people within the company, and how those functions are built, sized and prioritized. Rather than create static data points, exegraphics also account for trends and change over time.

Here’s one way to think of it: Intent data reflects small-sample-size data points where a prospect has engaged with your company in some lightweight way. Going after those prospects on that data point alone is like fishing based on where you see a ripple on the water. You know at least one fish is swimming there, and if it’s hungry, it might bite.

Exegraphic data, on the other hand, goes deeper than surface-level interactions to understand broader behaviors and patterns. In the fishing metaphor, you’d have a working knowledge of where schools of fish travel in the lake during different seasons and times of day. You’d know what they like to eat and when they’re most active. You’re not chasing ripples; you’re casting a lure where you know it’s most likely to land a hungry fish.

Combining forces to focus your sales strategy

Now you could argue that the best way to fish is both to understand the deeper behavioral patterns, and to look for the ripples that signal a live one. We agree.

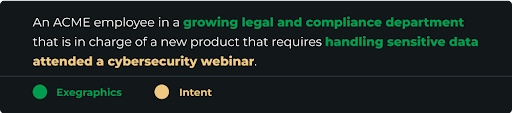

Every prospect can potentially exhibit both intent signals and demand signals, as in this case:

If you’ve already implemented an intent data provider’s system to capture the potential desires of individual prospects, great: keep using it. Alongside that, Rev can identify the exegraphics that your best customers share. We use millions of behavioral data points from thousands of companies to understand what characteristics underlie your best-fit prospects’ needs and create an aiCP (an AI-supported ideal customer profile) to build you a prospect pipeline from the companies with the top “Rev Scores.”

Layering your existing intent data atop the aiCP offers even clearer direction for your sales and marketing strategies, combining the fish’s behavior with the ripples atop the water.

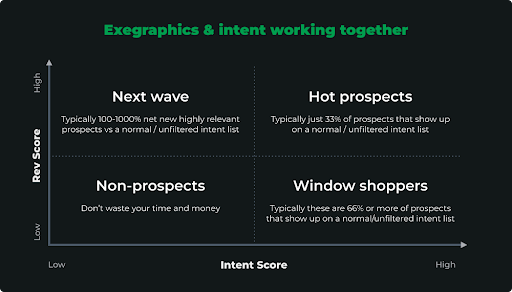

This matrix describes four primary scenarios for combining exegraphics and intent data:

Next wave: high Rev Score + low intent score

These target companies demonstrate the right heavyweight behaviors to match your aiCP. They act like your current best customers on the inside, and for those reasons they are highly likely to have a need for your product or service—even if they don’t know it yet, or haven’t acted on it yet.

Your strategy: Nurture these next-wave prospects.

These companies are ripe for a higher-volume nurture campaign. They may not be fully aware of a looming pain point, or that your company offers solutions for it. So, start creating those relationships. At the same time, you can monitor these prospects for intent signals—any way they are responding to your nurture campaign or seeking more information, which could bump them into the “hot prospects” category below.

Window shoppers: low Rev Score + high intent score

We mentioned window shoppers above. These prospects are often false positives. They demonstrate interest or curiosity, but the underlying exegraphics reveal they may not be a likely best fit because they don’t share many similarities with your best or ideal customers.

Your strategy: Delegate and deprioritize.

These prospects’ high-intent scores come at a low cost to them (often nothing more than offering an email address). The good thing is, interacting with them can remain a low-cost proposition for you, too. Don’t ignore them, but don’t expend time and resources on them, either. You can route them to automated marketing campaigns until they demonstrate a more serious interest.

Non-prospects: low Rev Score + low intent score

Odds are, your product isn’t useful to everyone out there. These companies have not shown significant interest in your product, and their exegraphics don’t demonstrate much likelihood that they ever will.

Your strategy: Simply ignore them.

Sometimes, you might want to think non-prospects are an untapped market. Most often, they’re not worth your time. The ROI on marketing to these companies would be minuscule, and odds are they’d be unsatisfied customers anyway. Unless these companies start to demonstrate some interest or radically evolve closer to your ideal customer, just don’t even bother.

Hot prospects: high Rev Score + high intent score

These are the golden-ticket prospects. The holy grails. The unicorns. Not only do they look and act like your ideal customers, but they’re also demonstrating a readiness to engage and buy. Do we really need to explain why you should call these companies right now?

Your strategy: Go for it! Route them to your sales team for immediate action.

Final thought: Exegraphics and intent data are more powerful together

Of course we believe that exegraphics are the most powerful tool for any RevOps leader. We know of no more comprehensive way to understand what makes your best customers tick, and to identify your true ideal customer profile.

Yet there is no denying that intent data augments the precision and strength of exegraphics. With exegraphics alone, absent intent data, your sales team knows they might have to spend time selling the idea before selling the product. But knowing which prospects function much like your existing success cases and which ones are already looking at the solutions your team offers?

Well, we can’t promise the trout will jump right in your boat. That’s no fun. But with exegraphics and intent data playing together, your sales team can focus its efforts on the greatest likelihoods of landing satisfied customers.

Need help getting started with exegraphic data? Contact us at Intelligent Demand, we’d love to work with you.